How Much Does a Dollar General Franchise Cost?

Last Updated on February 27, 2024

Written by CPA Alec Pow | Content Reviewed by ![]() CFA Alexander Popinker

CFA Alexander Popinker

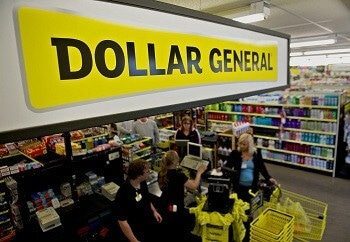

Looking to start a retail business? Dollar General may be one lucrative franchise opportunity worth exploring. With over 18,000 stores and $34 billion in annual sales, Dollar General continues its rapid growth across America.

But what is the total investment cost to join this retail empire? This comprehensive guide examines the Dollar General franchise cost and provides key details on startup expenses, operational costs, profit potential, and more to empower your business decisions.

Highlights

- Initial investments range from $377,000 to $536,000 including franchising fees and startup costs.

- Operational expenses like staffing, inventory, and rent exceed $500,000+ annually.

- Site selection and construction costs add $250,000 to $500,000+ to startup costs.

- Training and ongoing support are provided by the franchisor.

- 5% royalties apply, with a potential for 20%-50%+ net profit margins.

- In-depth market analysis is key to optimal site selection.

- Multi-unit franchising allows for expansion and growth.

How Much Does a Dollar General Franchise Cost?

The initial franchise fee to open a new Dollar General store is $40,000. This licensing cost grants you rights to the Dollar General brand, training, and support systems.

However, this is just one expense in the total startup investment which ranges from $277,000 to $386,000 on average. This covers real estate, leasehold improvements, fixtures, equipment, technology, inventory, supplies, licenses, permits, signage, marketing assets, and more to build out your retail store.

Working capital and cash reserves of $100,000 to $150,000 are also recommended to cover salaries, utilities, and operating costs until the new store generates revenue. Overall, the total initial investment runs from $377,000 to $536,000.

ProfitableVenture provides a detailed breakdown of the cost of a Dollar General franchise:

- Minimum cash outlay: $50,000

- Total investment range: $65,900 – $463,000 (may vary based on products sold)

- Initial startup cost: $25,000 to $350,000

Vetted Biz mentions that the estimated cost to open a Dollar General franchise would be between $1,000,000 to $2,000,000. However, Dollar General stores are not available for franchising currently.

Food Truck Empire discusses alternative dollar store franchises and their costs:

- Franchise fees: $20,000 to $50,000

- Initial investment: $75,000 to $150,000

- Liquid capital requirement: More than $200,000

This cost varies based on real estate values, the size and condition of the leased building, and geographic location.

Ongoing Operational Costs

Once open for business, franchisees face recurring operational expenses including:

- Inventory – Purchasing and managing merchandise inventory across over 30 product categories represents one of the largest recurring costs. Plan for $200,000 to $300,000 in average inventory value.

- Staffing – Hiring and managing staff for the store will require an estimated $150,000 to $250,000 annually for manager salaries, hourly worker wages, and benefits.

- Rent – Leasing commercial real estate for the store at a visible, high-traffic location comes with expensive rent of around $72,000 to $144,000 per year.

- Marketing – Ongoing advertising, promotions, and community engagement requires an annual marketing budget of $25,000 to $50,000+.

- Utilities – Expect to pay $25,000 to $50,000 or more annually for electricity, gas, waste management, security, and other utilities.

- Operations – General upkeep, repairs, supplies, technology, and services involve additional costs of $50,000+ each year.

Site Location and Construction

Choosing a prime retail site for your Dollar General franchise and designing the layout requires extensive planning. Site selection experts from the franchisor will assess potential locations based on traffic counts, demographics, proximity to competitors, and visibility.

You might also like our articles about the cost of opening a Walmart, Dollar Tree, or Sephora.

Plan for $7,500 to $15,000 in site selection fees.

Store sizes average 7,400 square feet, with minimum floorplans of 6,000 square feet. After securing real estate, building out and renovating the space to Dollar General’s specs involves construction costs averaging $250,000 to $500,000.

These costs range widely depending on location, permits, contractor rates, and custom finishes.

Training and Support

Dollar General provides an initial 5 week long training program on leadership, customer service, merchandising, and operations for designated managers at the franchisor’s headquarters. Trainees are responsible for travel and lodging costs during this onboarding.

Ongoing support includes field operations guidance, analytics, regional directors, IT systems, proprietary software, an intranet library, and more resources to help franchisees build their business. There are some nominal fees for annual conferences and training materials.

Licensing and Agreement Fees

The standard Dollar General franchise agreement is for an initial 10-year term with renewal options. Apart from the initial $40,000 franchise fee, Dollar General charges a 5% royalty fee on gross sales. Some cooperative advertising fees and national marketing contributions may also apply.

The standard Dollar General franchise agreement is for an initial 10-year term with renewal options. Apart from the initial $40,000 franchise fee, Dollar General charges a 5% royalty fee on gross sales. Some cooperative advertising fees and national marketing contributions may also apply.

Franchisees must adhere to all brand standards and legal compliance to avoid penalties or termination. An attorney should review the franchise disclosure documents and licensing agreement. Legal fees range from $7,500 to $15,000.

Financing Options

Qualified franchisees with strong credit, assets, and net worth can explore financing to cover the $250,000 to $500,000 startup costs through:

- SBA-backed loans – The Small Business Administration guarantees loan programs which can provide favorable rates and terms for franchises.

- Rollovers for Business Startups – 401K funds can be invested in your franchise without early withdrawal penalties.

- Traditional business loans – Banks, credit unions, and alternative lenders offer various small business loan products.

- Vendor credit – Some franchisors offer direct financing programs or partnerships with lending institutions.

- Equity investment – Taking on partners or investors allows you to leverage their capital.

Profitability and ROI

The earning potential of a Dollar General franchise depends on your location, local economic conditions, competition, operational efficiency, and more.

However, mature Dollar General stores can generate over $2 million in annual sales with strong profit margins in the 35% to 40% range thanks to bulk purchasing power.

This allows a typical store to produce $700,000 to $800,000 in gross profits. After expenses, owners may realize 15% to 25% net profits, equaling $100,000 to $250,000 in owner earnings. With total investments averaging $500,000, Dollar General franchisees can achieve an impressive 20% to 50% annual ROI.

Market Analysis and Strategy

To select a profitable location that matches Dollar General’s target customer demographic, an in-depth market analysis is required examining factors like population density, household incomes, area retail spending, shopping patterns, competitors, traffic counts, visibility, parking, proposed site visit performance, and growth projections for the area.

Strategies for competing in the discount retail sector include leveraging Dollar General’s massive economy of scale, focusing on convenience, targeting necessity purchases, controlling operating costs, private label branding, placing small stores in rural markets, and more.

Expansion and Growth Opportunities

Dollar General encourages multi-unit franchising, allowing qualified franchisees to continuously expand their store portfolio over time after successfully launching and running their first location.

This provides opportunities to build retail empires covering large territories. The brand aims to eventually reach over 26,000 stores nationwide.

Frequently Asked Questions

Is Dollar General profitable?

Yes, Dollar General is a highly profitable franchise opportunity. The combination of low startup costs compared to revenue potential, economies of scale, strong branding, and lean operations leads to excellent profit margins for store owners.

Mature Dollar General locations can generate over $2 million in annual sales. After expenses, owners typically realize 15% to 25% net profit margins, equaling $100,000 to $250,000+ in earnings per store.

With total investments averaging $500,000, this results in an impressive 20% to 50%+ annual return on investment. The business model, product mix, purchasing power, and ideal store economics allow Dollar General franchisees to operate very profitable retail stores.

Is Dollar General a good investment?

Dollar General is considered an excellent franchise investment opportunity. The relatively low total startup cost of $377,000 to $536,000 combined with strong sales and profitability makes for a high-return investment.

The potential to earn over $250,000 in annual profits on a $500,000 initial outlay gives investors a 20-50% ROI each year. Additionally, Dollar General’s rapid nationwide expansion and brand dominance provide a stable, growing franchise system to invest in.

The corporate support, training, operations model, supply chain leverage, and other resources provided to franchisees further reduce risk and enhance investment value. Overall, Dollar General’s high profit potential, corporate strength, growth, and support make it a smart franchise investment.

Is Dollar General a good long term stock?

Dollar General is widely regarded as a good long-term stock investment. The company has an impressive track record of consistent growth and shareholder returns.

Dollar General stock has grown over 650% in the past decade thanks to rapid new store openings, same-store sales growth, operating margin expansion, and excellent financial performance.

The company is debt-free with $2.2 billion in cash to fund continued growth. With plans to eventually operate over 26,000 stores across the U.S., Dollar General has tremendous room for long-term expansion and earnings growth.

The recession-resistant discount retail model also makes it a defensive stock. As a low-cost leader in an essential industry, Dollar General is poised to continue delivering strong returns for long-term investors.

I would like to open a Dollar General store in my area

I would like information

I would like more information to open a store

Who do i need to talk to about the Dollar General start up