How Much Does an Irrevocable Trust Cost?

Last Updated on May 19, 2024

Written by CPA Alec Pow | Content Reviewed by ![]() CFA Alexander Popinker

CFA Alexander Popinker

The term irrevocable trust refers to an arrangement for estate planning in which the terms cannot be changed, modified, or terminated without the permission of the beneficiary of the grantor. After effectively transferring all ownership of the assets to the trust, the grantor legally removes all their property rights. Therefore, an irrevocable trust may reduce estate taxes.

How Much Does an Irrevocable Trust Cost?

The cost of establishing an irrevocable trust is on average between $1,500 to as much as $7,000, depending on the complexity of the arrangement.

For the average individual, establishing a trust costs around $1,500 to $3,000 if you hire an attorney to build your trust.

On the other hand, trusts that are extremely complex and expensive for wealthy individuals can cost upwards of $5,000 to $7,000.

According to several sources, to create an irrevocable trust and hire an estate planning lawyer, you will have to spend a significant amount of money. For a simple irrevocable trust, you can expect to pay $1,000 to $4,000 in legal fees alone. However, if you feel confident you can create these documents yourself, a lawyer may evaluate the papers prepared by you within two or three hours and bill around $350 to $500 per hour.

Lodmell.com states you will only spend between $2,500 and $7,500 to set up an irrevocable trust.

Factors that affect the price

Estate

The cost to set up a trust depends on the size of the estate, lands, or homes in question. This influences the period of time and complexity in preparing the documents. Also, the amount of investments will directly affect the cost.

You might also like our articles about the cost of estate planning, abstract of title creation, or the process of contesting a will.

Lawyer charges

Lawyers specialized in contested litigation are expensive and their fees will depend on their experience and location. So, in order to have an irrevocable trust done, you can expect a bill that will be in the thousands of dollars.

Fees

When a lawyer has to draft an irrevocable trust, you will actually benefit from a range of services that will be conducted under a fee. Most irrevocable trusts will cost between $600 and several thousand dollars, although the legal costs will probably vary from one location to the other. If you need additional legal services like assets to trace or additional research, these charges can increase even further.

Irrevocable trust overview

When setting up an irrevocable trust, three main parties will be involved. First is the grantor, which is the one who creates the trust. The second party is the beneficiary or beneficiaries, who will receive the trust. The third party is the trustee, the person who administrates and manages the trust. The trustee can be a lawyer, a banker, or any legal entity.

To establish an irrevocable trust, a trust agreement is needed. In this legal form will be described the association of the parties and the administration and division of the estates identified in the trust. An attorney is typically responsible for preparing and executing the trust agreement in accordance with state law.

What are the extra costs?

Transfer fees and deposit fees are extra costs that may be added to your expenses. These fees are for transferring the ownership of your estate into the irrevocable trust. Fees can range anywhere from $35 to $120 for each transaction.

Transfer fees and deposit fees are extra costs that may be added to your expenses. These fees are for transferring the ownership of your estate into the irrevocable trust. Fees can range anywhere from $35 to $120 for each transaction.

Any changes to the accounts and assets, such as names, will also come with additional costs and legal fees.

Take into consideration that besides the regular fees for the irrevocable trust, the trustee may charge an additional fee for the administration of the properties. Other extra costs such as accounting expenses will probably have to be considered as well.

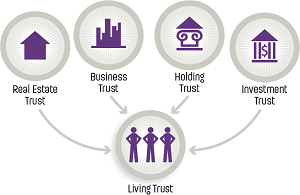

Other options when you need to set up a trust

- A revocable living trust is a type of trust that can be modified or canceled at any point in the owner’s lifetime and is still charged federal estate taxes.

- Dynasty trust – is a long-term trust where you can leave your assets from generation to generation.

- Qualified personal residence trust –This type of trust is designed to allow the terms and conditions of the trust to fluctuate, instead of being a fixed amount, as the value of your home will rise and fall with the market.

Important things to consider

The grantor does not have any responsibility in paying estate taxes, after including estates and assets in the irrevocable trust.

Trust Kit is one way to save up some money. These kits come in software packages or books with legal form, to create an irrevocable trust. Its cost is somewhere between $60 to $600 and needs no outside assistance. You should look for a kit in accordance with the laws of your state.

Your estate plan can be assisted by a financial advisor.

Leave a Reply

Want to join the discussion?Feel free to contribute!